House Panel OKs Short-Term Health Blocker Bill

One idea that came up was making ACA premium tax credits available to higher-income consumers.

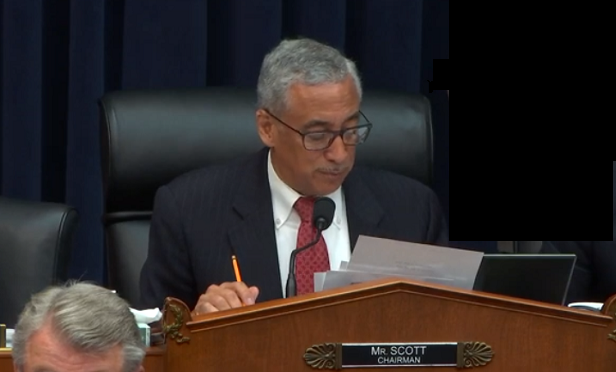

Rep. Bobby Scott, D-Va. (Photo: House Education and Labor)

Rep. Bobby Scott, D-Va. (Photo: House Education and Labor)Members of the House Education and Labor Committee voted 26-19 Tuesday to support H.R. 1010, a bill that would block the Trump administration’s short-term health insurance duration regulations.

If the bill took effect as written, it would limit the benefit period for short-term health insurance policies to three months. Today, a state can let the same short-term health insurance policy stay in place, with renewals, for up to three years.

All Democrats who participated in the House Education and Labor H.R. 1010 markup meeting voted to back the bill, and all Republicans who participated voted against it.

(Related: House Bills Could Set Federal Short-Term Health Disclosure Standards)

House Education and Labor shares jurisdiction over the bill with the House Energy and Commerce Committee and the House Ways and Means Committee.

House Energy and Commerce members voted April 3 to support the bill by a 30-22 party-line vote.

At press time, House Ways and Means had not scheduled an H.R. 1010 markup.

Short-Term Health Insurance History

Traditionally, consumers used short-term health insurance to protect themselves while they were between jobs, or when they had just gotten jobs and were not yet eligible for employers’ group health plans.

The drafters of the two statutes included in the Affordable Care Act package exempted short-term health insurance from the ACA underwriting, benefits and pricing rules that apply to individual major medical insurance.

Before April 1, 2017, each state could decide for itself how long a short-term health insurance policy could last, or whether an insurer could sell short-term health insurance to its residents.

The administration of former President Barack Obama adopted a regulation that put a three-month benefits period duration cap on short-term health insurance, in an effort to keep short-term health insurance from luring younger, healthier consumers away from the individual major medical insurance market, or from exposing consumers to the risk of buying coverage

The Trump administration completed work on regulations reversing the Obama administration cap on “short-term, limited duration” benefits duration periods in August 2018.

The Markup

House Education and Labor Committee members used the markup mainly to rehash old arguments for and against the ACA major medical insurance market framework.

Rep. Bobby Scott, D-Va., the chairman of the committee, said H.R. 1010 is a consumer protection measure.

“In many cases, consumers purchasing short-term plans are not even aware of these risks because the Trump administration is allowing short-term plans to be sold alongside plans that comply with federal consumer protections,” Scott said at the hearing, which was streamed live on the web. “A recent survey shows that most consumers increasingly expect their health insurance to automatically reflect the ACA’s consumer protections.”

Rep. Virginia Foxx, R-N.C., the highest-ranking Republican on the committee, questioned why the House Education and Labor Committee had any jurisdiction over the bill.

She and other Republicans on the committee said H.R. 1010 would reduce consumers’ choices, not protect them.

“House Democrats are reiterating that they favor one-size-fits-all federal mandates instead of respecting the judgment of state lawmakers and authorities to act in their state’s best interest,” Foxx said.

Rep. Gregorio Kilili Sablan, a Democrat who represents the Northern Mariana Islands in the House, was one of the few lawmakers at the hearing who talked about specific concerns about short-term health insurance, other than general concerns about short-term health insurance policies’ general failure to comply with the ACA essential health benefits package rules and benefits richness rules.

Sablan noted that, under the current rules, a short-term health insurance issuer could refuse to renew the coverage of an insured who had health problems, or rescind the coverage of a consumer who turned out to have an undisclosed pre-existing condition.

In that situation, a consumer might be unable to get any health coverage until the next ACA individual major medical insurance open enrollment, Sablan said.

The individual major medical open enrollment period, or time of year when people can apply for individual major medical insurance without showing they have what the government classifies as a good reason to be shopping for coverage, now runs from Nov. 1 through Dec. 15.

Rep. Kim Schrier, D-Wash., talked about some Democratic proposals for responding to the high cost of individual major medical insurance, as alternatives to encouraging consumers to hold down costs by buying non-ACA products.

Schrier said the alternatives including making ACA individual major medical premium tax credits available to people earning up to 600% of the federal poverty level, rather than 400%; capping what individuals and families have to pay for coverage at 8.5% of their income, rather than 9.86%; and letting consumers in areas with little commercial health insurance market competition buy into Medicaid.

Resources

Links to information about the H.R. 1010 markup, including a video of the meeting, are available here.

— Read Feds Unleash Short-Term Health Insurance From Obama-Era Limit, on ThinkAdvisor.

— Connect with ThinkAdvisor Life/Health on LinkedIn and Twitter.

Next Article Previous Article